Biography

I am an Economist in the Research Department at the International Monetary Fund. My research focuses on the relationships between technology, finance, trade and development.

Disclaimer: All views expressed on this site are my own and do not necessarily reflect the position of the IMF.

- Fast payment systems

- Crypto and CBDC

- Tokenization

DPhil in Economics, 2021

University of Oxford

MSc in Development Economics, 2017

University of Oxford

BA in Philosophy, Politics & Economics, 2015

University of Oxford

Working Papers

Publications

Policy Work

& Other Writing

Payment Frictions, Capital Flows, and Exchange Rates | SUERF Policy Briefs | November 2025

India’s Frictionless Payments | IMF Finance & Development | Fall 2025

Growing Retail Digital Payments: The Value of Interoperability | IMF Fintech Note | June 2025

Discussion of “New Technologies and Jobs in Europe” by Albanesi et al. | ASSA | January 2025

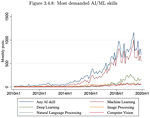

AI and Services-Led Growth | IMF Research Perspectives | May 2024

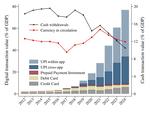

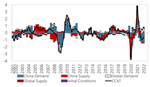

Macro-Financial Impacts of Foreign Digital Money | IMF Working Paper and Fintech Note | December 2023

Banks' Joint Exposure to Market and Run Risk | IMF Working Paper | September 2023

Malaysia 2023 Article IV Consultation | IMF | June 2023

Recovery Unabated Amid Uncertainty | IMF Regional Economic Outlook | May 2023

Geoeconomic Fragmentation and Asia | IMF Regional Economic Outlook | October 2022

Post-COVID Scarring in Asia | IMF Regional Economic Outlook | October 2022

Malaysia 2022 Article IV Consultation | IMF | April 2022

Crypto for Dummies | Brown Bag Lunch | December 2021

Strange New World: Globalization, AI and Development | Oxford Global Exchanges | August 2021

Rescue: From Global Crisis To A Better World | Ian Goldin | May 2021

Rethinking Global Resilience | IMF Finance & Development | Fall 2020

Fragility to Strength: Lessons in Building State Resilience from Around the World | Reform | October 2020

Creating Network Diagrams in Gephi | CSAE Coders' Corner | October 2020

Technology and the Future of Work | Center for International Cooperation | September 2020

The Just Transition in Energy | Center for International Cooperation | September 2020

Multilateralism and the Search for Collective Institutional Leadership and Governance | DOC Rhodes Forum | August 2020

Experience

Macro-Financial Division, Research Department

Regional Studies Division & Malaysia Team, Asia and Pacific Department

Courses taught:

- Undergraduate — Economics of Developing Countries

- MSc Economics for Development — International Trade

- DPhil Continuing Education — Econometrics

Contact

- acopestake@imf.org

- 1900 Pennsylvania Avenue NW, Washington, DC, 20431