Crypto Market Responses to Digital Asset Policies

Abstract

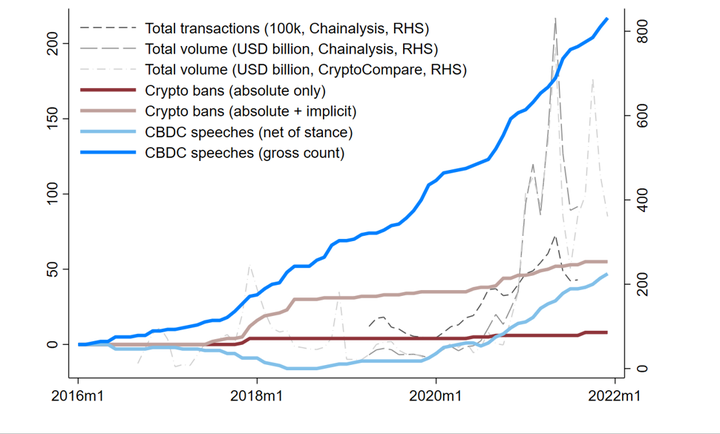

We construct daily databases of crypto bans and policy statements concerning central bank digital currencies (CBDCs) to estimate their effects on crypto trading volumes for an unbalanced panel of 116 countries from November 2016 to December 2021. We find that trading volume falls by up to 55% in the week after the announcement of a ban, and by up to 25% after a CBDC-supportive speech by senior central bank officials. For the strictest bans, this reduction persists over the subsequent quarter, driven by a reduction in trading by institutional investors. The results suggest that crypto market participants pay significant attention to government policy on digital assets.

Type

Publication

Economics Letters

Forthcoming.